![]()

NEXUS points out that both residential and commercial property markets in the first quarter had more stability. The recent election should boost the long-term confidence for both investment and real demand.

Condominium Market

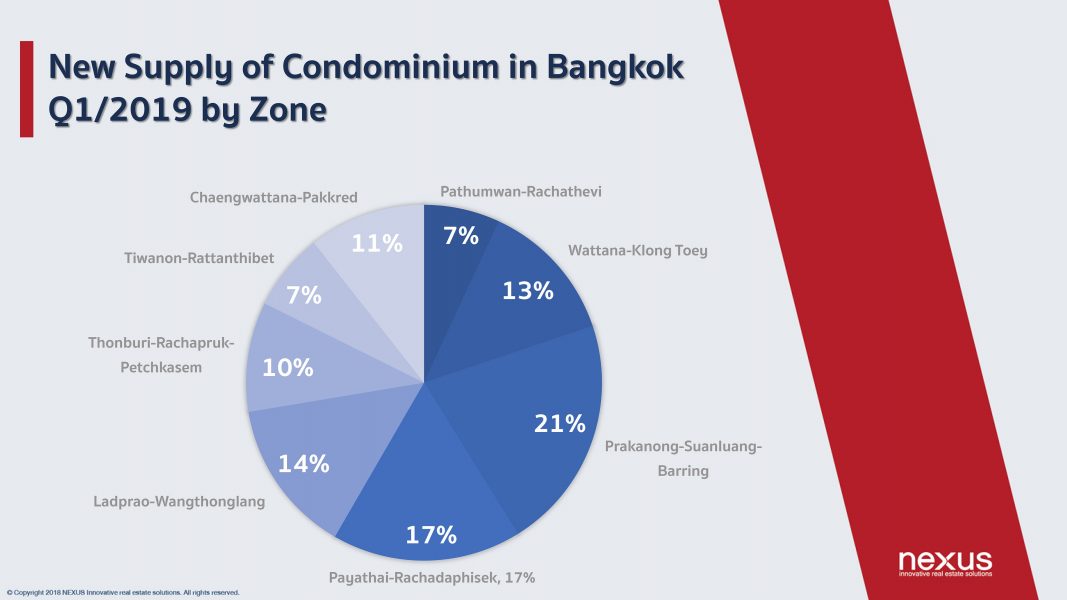

Mrs. Nalinrat Chareonsuphong, Managing Director of Nexus Property Marketing Company Limited, says that according to the survey, the condominium market in Bangkok in the first quarter of 2019 had the new supply of 11,300 units from 30 projects, decreasing 20% from the same period in 2018. The locations with the newest supply were Phra Kanong, Suan Luang, Barring (2,400 units, 21%), followed by Phayathai, Rachadapisek (1,938 units, 17%) and Ladprao, Wangtonglang (1,580 units, 14%).

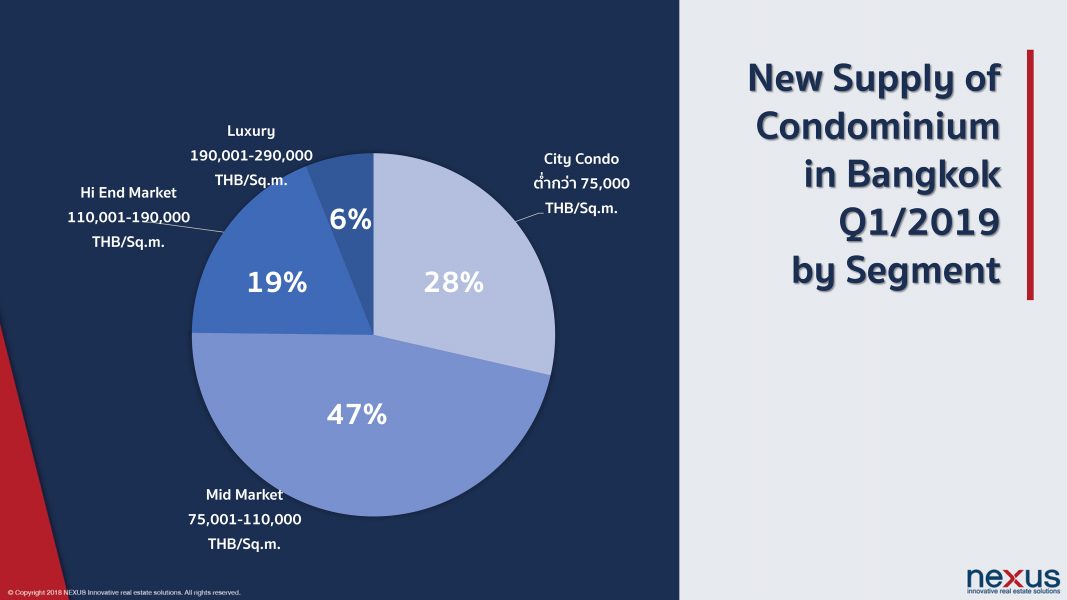

The overall picture of the condominium market saw several changes. For instance, majority of the new supply in the first quarter were the city condominiums with the price of not over 75,000 Baht/SQ.M and the mid-market with the price of not over 100,000 Baht/SQ.M, representing up to 75% of total new supply (approximately 8,500 units). Developers have changed their direction for their development and focus more on the products that match real demand in the market.

Besides, the new developers have confidence in the market. Some of them are small developers who have started the development for the first time. The number of new developers that are not listed on Thai bourse accounts for 47% of the overall developers, up from 30% in the past.

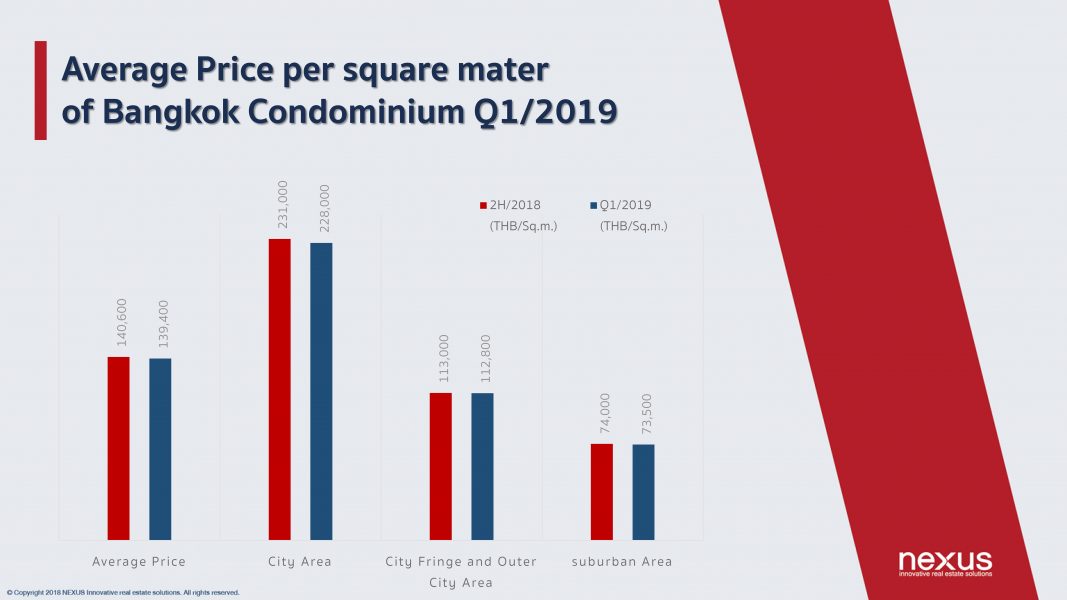

The new supply in the first quarter focused more on the mid-market. The average price in Bangkok was 139,400 Baht/SQ.M, slightly down 1% from 140,600 Baht/SQ.M. The average price of condominiums in other locations also declined slightly. However, the lower price did not affect the overall market significantly because those new supplies were located far from the city’s center.

For the trend of new supply this year, developers still focus on city condominium and mid-market. However, the market will experience more projects of luxury and hi-end condominiums from the listed developers who acquired the prime land since last year. The luxury and hi-end market remains attractive as developers compete in creating new concepts which focus on user experience and technology.

Most demand this year is predicted to come from real demand due to LTV measure and stricter loan approval, while city condominiums and mid-market are the most attractive for real demand. For the hi-end market, it needs to be cautious this year as it should be impacted by a fewer amount of Thai investors.

The average price in this market should surge not more than 5%-6%. More condominium projects for long-term lease will be developed on the government’s land as well as the private-owned land plots in the prime locations.

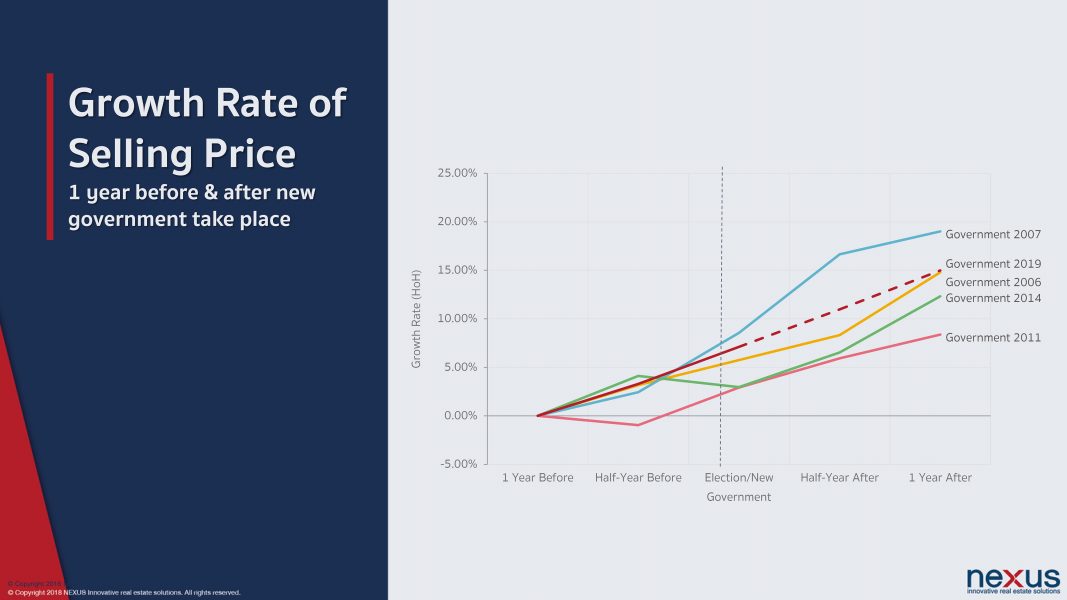

The market has been affected by the government’s policies from time to time. However, post the election, the confidence of international investors and foreign investment should resume. The change of property tax that will affect the price of condominium next year should stimulate demand of the second-hand condominium market. If the government reconsiders the property transfer tax and specific business tax to boost the trading in the property market, it will help stabilize the growth of the market of condominiums for investment.

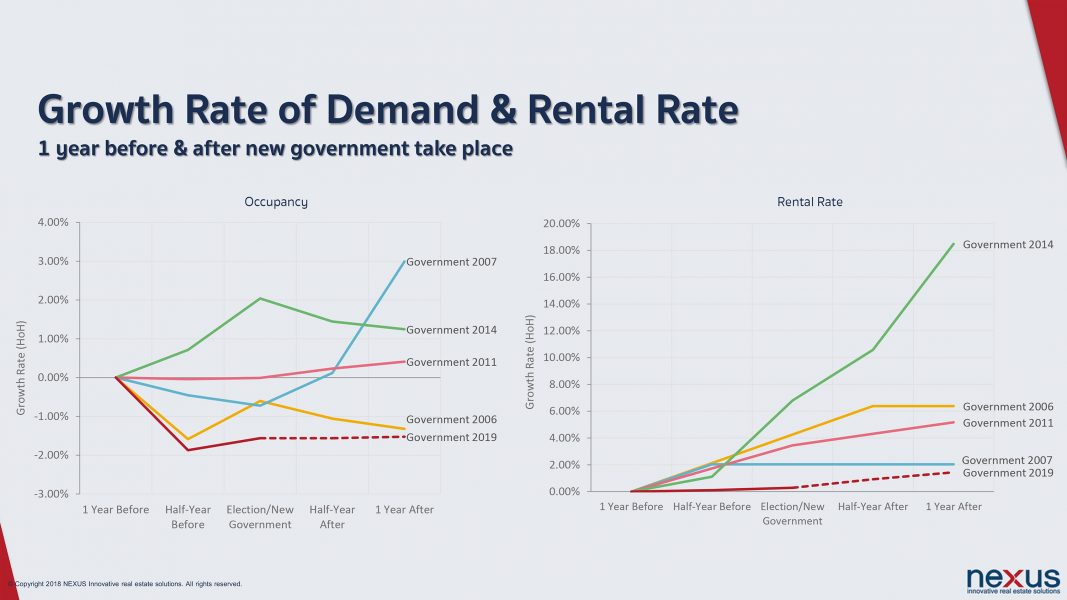

For commercial real estate, Mr. Teerawit Limthongsakul, Managing Director of Nexus Real Estate Advisory, comments that the office and the retail market had not been much affected by the election. The election is a positive factor to stabilise the property sector.

Office Market

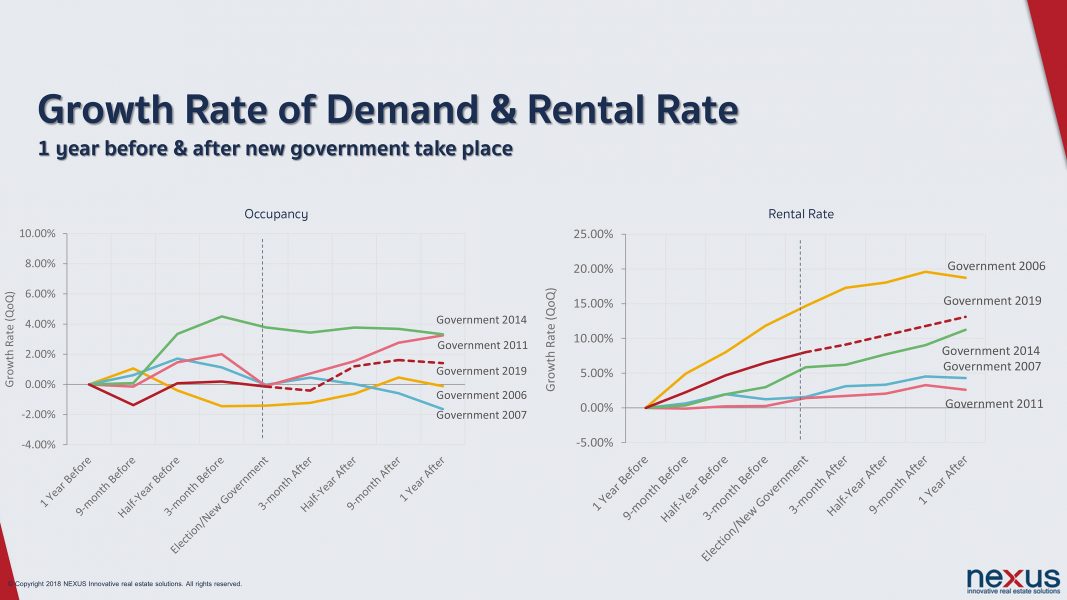

The office market experienced the least impact from all negative forces when is compared to other commercial markets. The occupancy rate remains higher than 90% and the average rental rate has continuously increased 4%-5% annually over the past 10 years.

The survey cites that the Grade A and Grade B office market in Bangkok in the first quarter of this year had a combined space of approximately 4.2 million square meters. Currently, the Grade A office market marked the average rental rate at around 980 Baht/SQ.M/month and the Grade B office market at 700 Baht/SQ.M/month. The average rental rate of the overall market was 810 Baht/ SQ.M/month, up 8% YoY.

Based on the locations, some CBD areas including Rama 1 Road – Ploenchit showed the occupancy rate up to 99% while the rental rate was higher than 1,000 Baht/ SQ.M/month. The occupancy rate of the office market in the CBD area has been an upward trend over the past 10 years as well as the rental rate.

The election would be one of the key factors to stabilise the property market. Thailand has passed many significant political situations since 2007, but the office market was hardly impacted. It has grown continuously in terms of occupancy rate and rental rate. NEXUS is positive with the office market and believes that it is likely to show continuous growth.

Retail Market

The retail market also gets a positive force from the election as the main factors to drive the retail market are domestic consumers’ confidence and spending from foreign tourists. Once the new government is appointed, it is believed to resume the confidence of both Thais and foreigners. At present, the retail market has good potential despite facing tough competition and the competition from e-commerce platforms.

In the last year’s end, the opening of a mega-mall project on the Chao Phraya River bank intensified the competition in the retail market. In 2018, Bangkok was ranked as one of the world’s most attractive cities thanks to tourism attractions including shopping centers especially on Central Retal Business or Rama 1 to Ratchaprasong intersection and Prompong where more than 100,000 tourists visited per day. The occupancy rate in these areas were over 95% and there were still plenty of shops/merchants in the waiting list.

According to a survey conducted by NEXUS, the new supply in the retail market in this quarter came from 101 The Third Place, The Market Bangkok By Platinum and Don Don Donki with a combined rental space of 70,000 square meters. This year it estimates that there will be a total new supply of approximately 140,000 square meters while there are plenty of commercial projects under construction and in the pipeline.

NEXUS cites that although developers give the importance to location and convenience, the political situation is another factor that can affect the commercial projects’ development and operation. That is because the political turmoils in the past had created the concern for tourists especially the protest in Rachaprasong area where it is the heart of shopping centers in Bangkok. Following the protest, the temporary shutdown of shopping center shrank the retail market. However, after the situation unravelled, the retail market in Bangkok has recovered quickly. This reflects the retail market has stability and the ability to grow continuously.

In terms of the rental rate, it has surged continuously despite having the political chaos. In the previous quarter, the rental rate was raised at a slower pace after the significant increase over the past few years. The average rental rate on G floor in the shopping centers in the first quarter was around 3,910 Baht/SQ.M./month and it tends to gradually higher in the near future.