![]()

The year has started well for Bitcoin and other crypto currencies. Since our January article, we have seen another high this last month for this golden “halving” year 2020, hitting around $10,496 for one whole Bitcoin. This represents a 52.1% profit (if sold on the high) for just two months so far.

I would question if there has ever been such a high performing asset class such as Bitcoin. Year-on-year, the “low” point has always been higher than the previous year except for one, back in 2015. How long this momentum may continue is anyone’s guess though certainly the feel within the market, is that this “will” and be the global currency of choice within the next decade.

When banks were first founded all those years ago, the creation of “something”, which can be exchanged between individuals in exchange for a “product” took off. This, in turn, would create some kind of local economy at various places around the globe. Individuals with different levels of skill sets could trade between each other for the benefit of each other. An individual who loved to build things for example could build a home for another who perhaps might be better suited to look after vegetables. Time spent on doing things could however be deemed a “cost” to an individual, since life itself has a timeline. The cost of doing things for others, results in using up, one’s own life and thus may determine the amount of that “something” which is exchanged.

The idea of having a trusted third party to handle payments & transactions between individuals while helping to “look after” people’s perceived wealth (a monetary value of the time spent doing things for others), could be considered an essential part of life.

Hard currencies flourished and the banks became profitable. Once this new perceived wealth stored within the banks accumulated, higher liquidity for the banks became available and then all kinds of fancy financial structures and products were launched. The whole concept and original idea however, was all before the Internet came along and globalisation for the masses became real. Ordering and paying for goods at the touch of a button instantly, from a company 20,000 miles away, then waiting a week for it to be delivered would most likely have put you in the mental institution 500 years ago possibly for talking like a space cadet!

The financial crisis of 2007-2008 was possibly the turning point and key milestone behind a new beginning of crypto. On August 18, 2008, Bitcoin.org was registered and then on October 31, 2008, the white paper for a “A Peer-to-Peer Electronic Cash System” was posted to a cryptography mailing list. The basic idea of a traditional bank was to be the “trusted third party” that would look after people’s wealth and act as a go between for payments etc. The financial crisis destroyed that confidence and almost instantly, Bitcoin was launched which provided a new internet mechanism, public ledger, which no longer needed that third party, since the new go-between was a computer code.

Whether that new creation of computer code is a foolproof and unbreakable mechanism is yet to be determined. However, since its launch, it is clear that a global movement is helping to push further mainstream with many banks now actively involved within blockchain technology, the component behind Bitcoin. In fact, there are reportedly banks already using blockchain technology to make transfers between themselves as the technology is deemed faster and more efficient. Banks are being forced to adapt into a brave new world of cryptocurrency and blockchain.

Traditional bank currencies are in some ways open to manipulation as governments and central banks are able to “print” new money at will thus increasing the supply and, in turn, reducing its value. A feature of Bitcoin is that there will only ever be 21,000,000 produced, the supply is therefore limited. Presently around 18,241,262 are in circulation and new coins are produced daily. The new supply of coins is being reduced however every 210,000 blocks which is roughly every four years. This means the amount of new coins produced will be reduced at specific times and events entitled “Bitcoin Halving”. The next scheduled “halving” is estimated to take place around May this year.

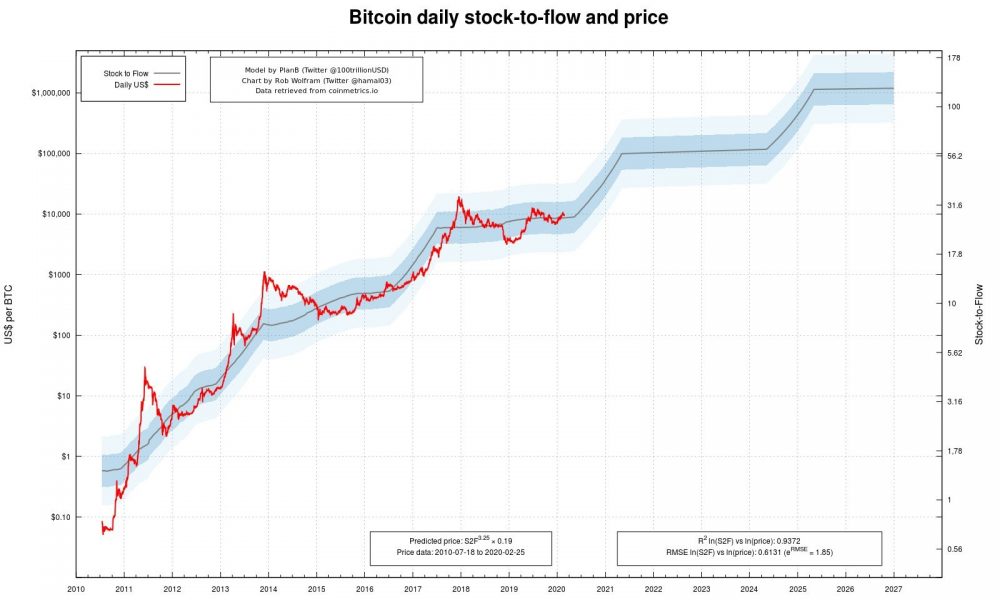

As a result of Bitcoin being a set immutable computer code with a specific timeline, schedule of events to reduce new coins being produced and finally with a set supply, various statistical models and forecast of pricing have been produced. One popular idea is that Bitcoin follows a “Stock-to-Flow” model and means following a predictable halving schedule, prices tend to increase. The model takes mathematical calculations and produces a decent match to how prices have been in the past, right back since Bitcoin was launched. Deviations away from the model are evident. However, all seem to come back within a range over time.

The idea that a forecast of price for Bitcoin can be produced into the future has the Crypto community split with high profile innovators in the space either slating it as trash or actually feasible. The main theorist (Plan B @100trillion Twitter handle) behind the “Stock-to-Flow” model challenges anyone saying “the proven cointegration is still there, everybody can verify it, until you prove it wrong.” One thing which catches an investor’s eye for the model is the “price forecast”. Anyone investing in the space with an eye on the price forecast likely has big numbers on their mind.

One thing for sure, is that the world is changing. We are at a point in history which we have never seen before when a complete radical global change and movement is happening. Elon Musk stated he plans to send a million people to Mars by 2050 by launching three Starship rockets every day and creating ‘a lot of jobs’ on the red planet. Is it practical, for an interplanetary species to carry hard currencies between planets or is a digital currency more likely. In theory, if Elon’s Space X Company delivers, one could purchase something on Mars using Cryptocurrency almost instantly on a public ledger over the internet. A traditional bank which was designed way back in history, when we hadn’t even been to the moon, is not equipped for that purpose.

At MBK Guarantee Co., Ltd, we offer mortgage finance on Thailand-based property with popular equity release and cash back available. We take security over the property and provide cash for you to invest as you please. Our interest rates are typically around 9.4% for a condominium and 12% for most other types of collateral. Up to 10 year term or age 70.

For further information on how to “Finance Property, Land & Condos in Thailand”, or a web-link to the “Thailand Condo Finance Map” which shows pre-approved condominium projects for finance, please feel free to email me, [email protected]OR, call 66 (0) 81278 5382 OR, Line ID stuartmaxwellfoulkes, I shall be happy to assist.

To speak with a native Chinese national, contact Rose on 66 (0) 95648 2913 or WeChat: rose215620 or email [email protected].

Note – This article is not to be considered as financial advice or a recommendation to invest into Crypto currency. This article also does not reflect on our company MBK Guarantee and all opinions are my own. Any decision one makes to borrow against a property puts the home at risk in terms of default and investments could go up, just as easily as they could go down.